Tax season is well underway and the Pennsylvania Department of Revenue is alerting residents to be on the lookout for scams.

Officials said the scams are created to trick people into turning over sensitive data and personal information.

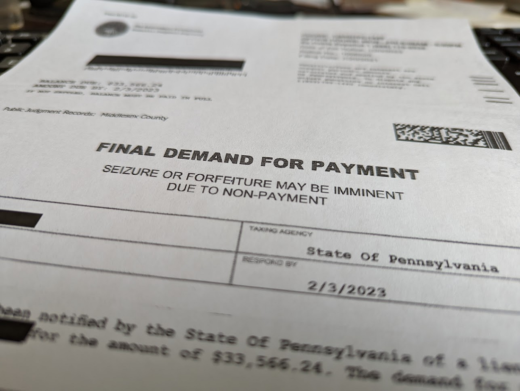

Fake letters that are mailed to taxpayers are one reoccurring fraud that has been reported to the agency. The “Final Demand for Payment” letters tell the recipient to call a phone number to pay a lien. If not, the letter threatens wage garnishment and the seizure of assets.

“We want Pennsylvanians to remember four simple words — don’t take the bait. Take a moment to think over the situation and make sure that you’re taking the proper steps to ensure that any notice you receive in the mail is legitimate,” said Acting Pennsylvania Department of Revenue Secretary Pat Browne. “We have received many reports on this scam that involves fraudulent notices. This is a common time of the year for scam artists to impersonate a government agency to victimize hard-working Pennsylvanians.”

Understanding the Scam

The scam notices are sent through the mail from phony entities that closely resemble the name of a collection agency or a state taxing agency. Keep an eye out for dubious claims or suspicious details, such as:

• The phony letters come from “Tax Assessment Procedures Domestic Judgment Registry.” No such entity exists.

• The letters do not include a return address. A notice from the Department of Revenue will always include an official Department of Revenue address as the return address.

• The recipient owes the “State of Pennsylvania” unpaid taxes, rather than the Commonwealth of Pennsylvania or Department of Revenue.

• The phony letters are very generic and do not include any specific information about the taxpayer’s account. Legitimate letters from the Department of Revenue will include specifics, such as an account number and any liability owed, to give the taxpayer as much information as possible. Letters from the Department of Revenue also include more detailed contact information and multiple options to make contact with the department.

• The phony letters focus on public records, such as tax liens, that anyone can access. Enforcement letters from the Department of Revenue include more detailed information about the taxpayer’s account and any liabilities that are owed.

Tips to Avoid This Scam

The Department of Revenue is encouraging Pennsylvanians to keep the following tips in mind to safeguard against these types of scams:

• Look Closely for Imposters: Scam artists will pose as a government entity or an official business. If you are contacted through the mail, phone or email, do not provide personal information or money until you are absolutely sure you are speaking to a legitimate representative.

• Examine the Notice: Scam notices often use vague language to cast a wide net to lure in as many victims as possible. Examine the notice for identifying information that can be verified. Look for blatant factual errors and other inconsistencies. If the notice is unexpected and demands immediate action, take a moment, and verify its legitimacy.

• Conduct Research Online: Use the information in a potentially fraudulent notice, such as a name, address or telephone number, to conduct a search online. You may find information that will confirm the notice is a scam.

Steps to Follow if You are Concerned About a Notice

If you are concerned about a potentially fraudulent notice, visit the department’s Verifying contact by the Department of Revenue webpage for verified contact information. This will help you ensure that you are speaking with a legitimate representative of the department.

Steps to Follow if You are a Victim of a Scam

The Pennsylvania Department of Revenue’s Bureau of Fraud Detection and Analysis has the goal of protecting and defending Pennsylvania taxpayers and their tax dollars against fraud. The bureau is a one-stop resource for all identity theft and tax fraud issues in the commonwealth.

If you believe you are a victim of tax fraud or tax-related identity theft, contact the Bureau of Fraud Detection & Analysis by emailing Ra-rvpadorfraud@pa.gov or calling 717-772-9297. The bureau’s phone line is open from 9 a.m. to 4:45 p.m. Monday through Friday.

For more information on ways to protect yourself from scams, visit the department’s Identity Theft Victim Assistance site. You can also find further information about protecting yourself online.